Why Overpaying for Dividend Growth Stocks Can Stall Your Wealth

MP Market Review - September 19, 2025

Summary

Welcome to this week’s MP Market Review – your go-to source for insights and updates on the Canadian dividend growth companies we track on The List! While we’ve expanded our watchlists to include U.S. companies, The List-USA, our Canadian lineup remains the cornerstone of our coaching approach.

Don’t miss out on exclusive newsletters and premium content that will help you sharpen your investing strategy. Explore it all at magicpants.substack.com.

Your journey to dividend growth mastery starts here – let’s dive in!

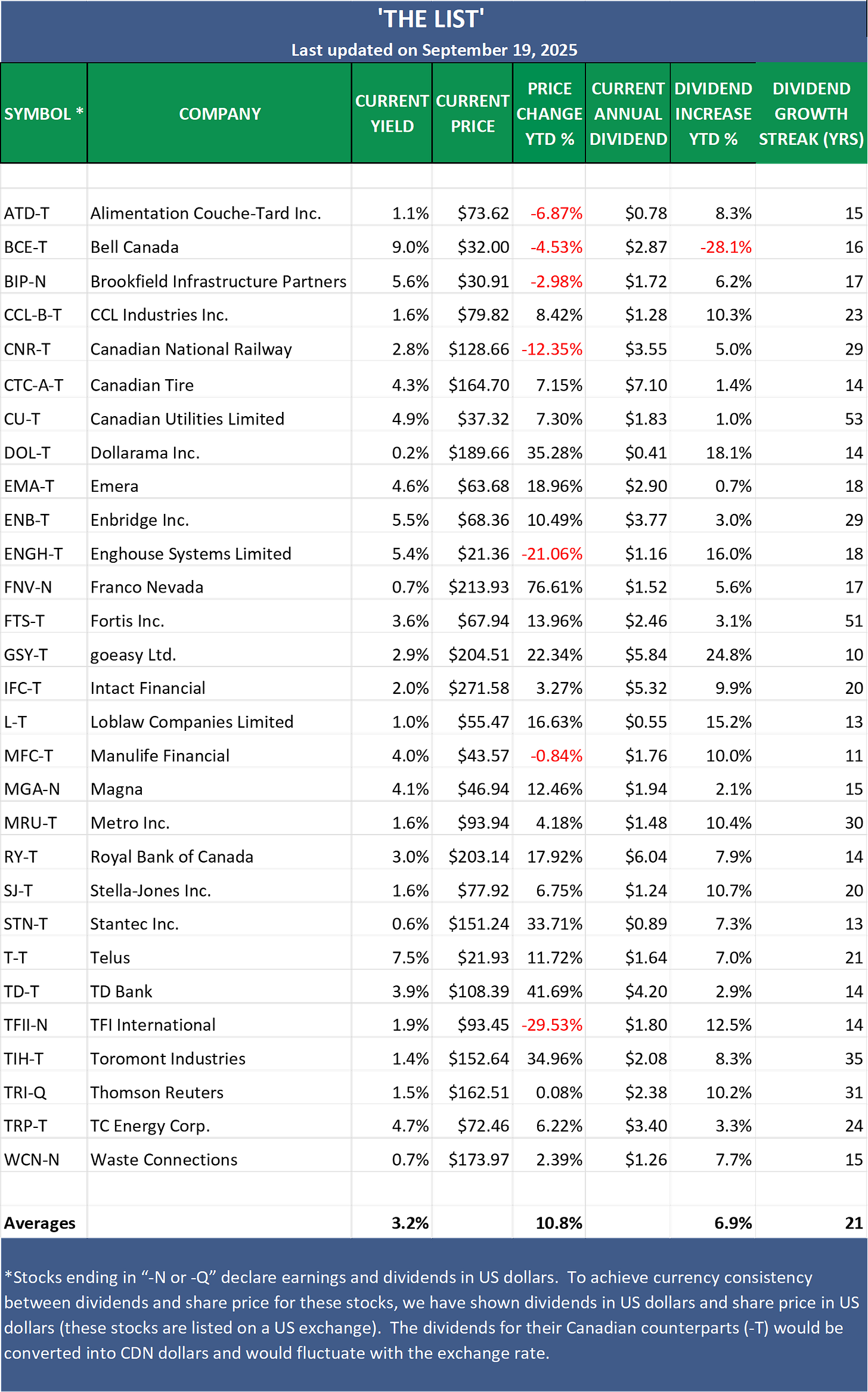

Last week, dividend growth of The List stayed the same with an average return of +6.9% YTD (income).

Last week, the price of The List was down from the previous week with an average return of +10.8% YTD (capital).

Last week, there were no dividend announcements from companies on The List.

Last week, there were no earnings reports from companies on The List.

This week, no companies from The List will report on earnings.

DGI Clipboard

“However, stock market valuations have reached some truly rarified air. The Shiller cyclically adjusted price-to-earnings ratio is hovering around 37.5. And, as David Rosenberg points out, Over 35 is, “the only cutoff point where every single time [the forward return] is negative.”

Jesse Felder, The Felder Report

Why Overpaying for Dividend Growth Stocks Can Stall Your Wealth

Intro

The quote above speaks to the S&P 500, but the lesson applies no matter where you invest: valuation matters. In our dividend growth investing process, we spend a lot of time emphasizing undervaluation and the importance of buying at a sensible price. For today’s article, though, I want to flip the script and look at the other side of the coin, what can happen when you buy stocks that are overvalued.

Dividend growth investing works because it combines two of the most powerful forces in wealth building: rising income and compounding. The best companies increase their payouts year after year, and over time the snowball effect creates serious results.

But there is a catch. Even the highest-quality dividend grower can deliver disappointing returns if you buy it at the wrong price. Paying too much for a great business is one of the most common mistakes investors make.

Why Quality Alone Is Not Enough

It is tempting to believe that a wide-moat business with a long dividend streak is always worth owning. The problem is that returns depend not only on business quality but also on the valuation you lock in when you buy. If the stock is trading far above its fair value, future returns get squeezed.

A strong dividend record cannot save you from a poor entry point.

The Three Levers of Returns

Three factors drive every dividend growth investment:

Dividend yield at purchase

Future dividend growth

Valuation multiple

If the starting yield is low because the stock is overpriced, the compounding engine is weakened from the start. Worse, when the valuation multiple eventually drifts back to its historical average, you can face years of stagnant or negative price performance.

Imagine a stock that usually yields 3 percent but now yields only 2 percent because the price has run ahead. For that stock to return to its normal yield, the price would need to fall by one-third. That is enough to wipe out several years of dividend growth.

The Hidden Cost of Overpaying

Buying an overvalued dividend stock does more than hurt your immediate returns. It also carries a heavy opportunity cost. Capital tied up in a stretched valuation is capital that could have been compounding at higher yields elsewhere.

Dividend Yield Theory helps investors avoid this trap. By comparing the current yield to long-term averages, you can quickly spot when a dividend grower has become too expensive.

Investor Psychology at Work

Many investors still pull the trigger on expensive stocks because of behavioral traps:

Fear of missing out after a big run

Anchoring to recent performance

Confirmation bias from hearing only bullish commentary

These biases can push you into thinking that valuation no longer matters. History shows otherwise.

Lessons From the Past

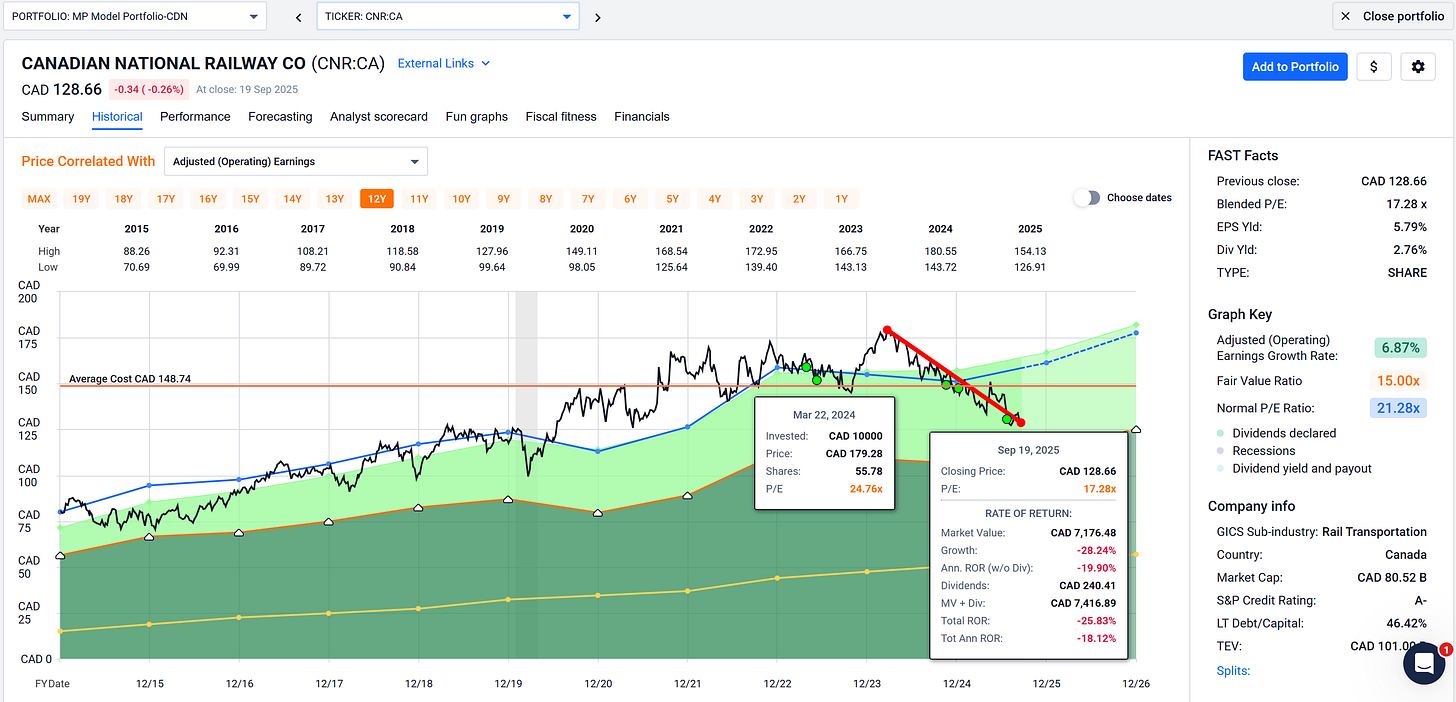

Even legendary Canadian dividend growers have gone through long stretches of poor returns when purchased at extreme valuations. Canadian National Railway (CNR-T) is a good example from the last few years.

The following colours/lines on the FASTgraphs chart shown below represent:

Black line: Price

Yellow line: Dividend

Orange line: Graham average of usually 15 P/E (price/earnings) for most stocks

Blue line: Normal P/E

Dashed or dotted lines: Estimates only

Green area: Earnings

Green dots: Purchases

CNR-T’s valuation reached its second-highest level in the past decade as of March 2024. For investors who bought at those highs, the road to meaningful returns may take time.

During the subsequent downturn, we have been selectively adding shares (green dots). While the stock has yet to find its bottom, our lower entry points increase the probability of achieving above-average returns once the recovery takes hold.

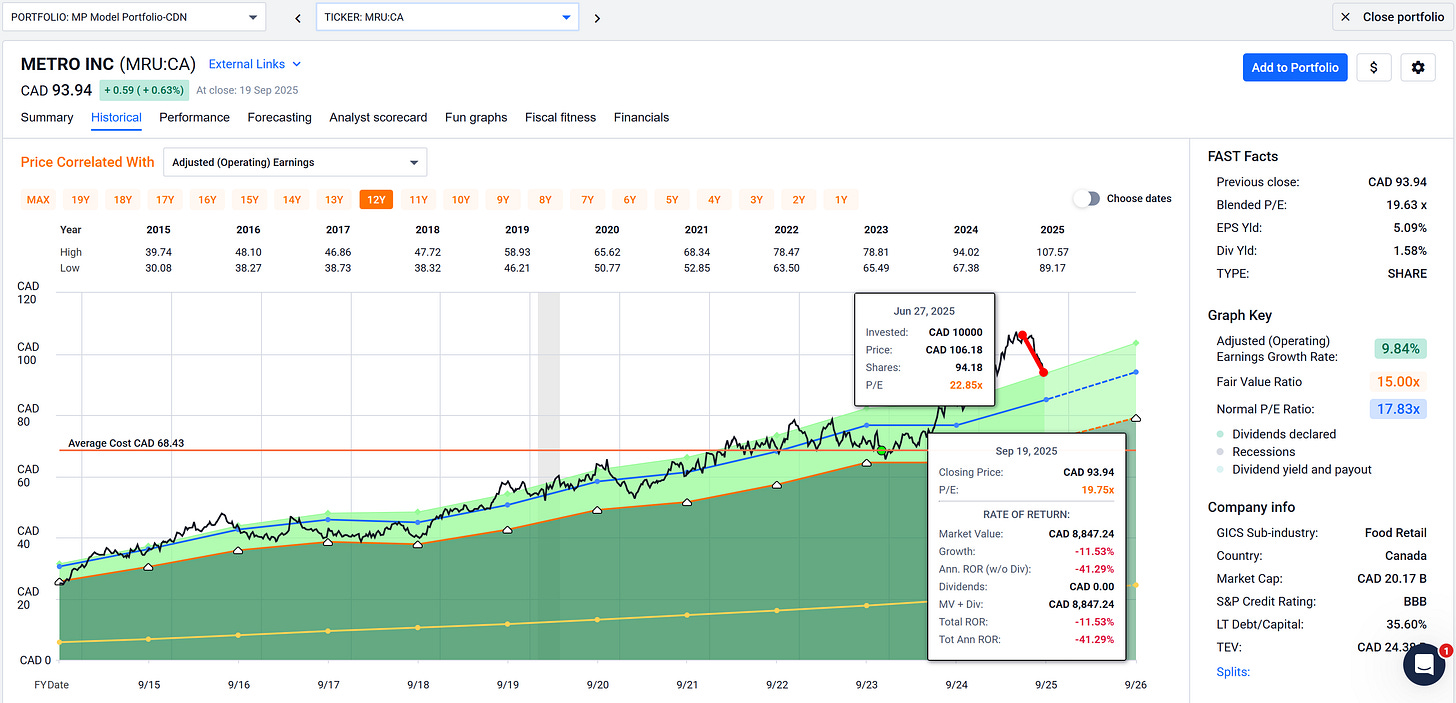

Fast forward to 2025, and we see a similar story with another quality dividend grower: Metro Inc. (MRU-T). After climbing to a historically high P/E multiple, the stock has begun to retrace. Where it ultimately settles is impossible to predict, but the lesson remains the same as with CNR-T. Valuation matters. By waiting patiently and only buying when the price makes sense, we tilt the odds in our favor. That was exactly our approach in 2023, when Metro’s P/E ratio came close to its lowest point of the decade (green dot), giving us a clear opportunity.

At present, we hold a modest 2% position in MRU-T, leaving us with plenty of dry powder to deploy when valuations once again align with historical fundamentals. This disciplined process of buying quality companies only at sensible prices remains at the heart of our dividend growth investing strategy.

Investors who buy at historical highs can endure long periods of weak performance while waiting for valuations to reset, even though dividends kept rising.

A Smarter Way Forward

Here are four practical ways to avoid the overvaluation trap:

Check the yield against history. If today’s yield is far below the 10- or 20-year average, be cautious.

Be patient. Great companies usually come back into range.

Keep a watchlist. Track your favorite names so you are ready when value returns.

Spread your buys. Invest gradually instead of all at once to reduce timing risk.

Takeaway

Dividend growth investing rewards patience and discipline. Quality matters, but price matters too. Overpaying locks in a weak starting yield, sets you up for valuation compression, and blocks capital from compounding elsewhere.

The winning formula is simple: combine quality with value. Buy dividend growers when they are attractively priced and let time and compounding do the rest.

Become a paid partner, and I’ll show you exactly how I do it. With real money. In real stocks. In addition, gain full access to this post and exclusive, subscriber-only content. We do the work; you stay in control. Subscribe today and take your dividend growth investing to the next level!

DGI Scorecard

The List (2025)

The Magic Pants 2025 list includes 29 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on The List:

Dividend growth streak: 10 years or more.

Market cap: Minimum one billion dollars.

Diversification: Limit of five companies per sector, preferably two per industry.

Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from The List annually on January 1. Prices and dividends are updated weekly.

The List is not a portfolio but a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on The List. In other words, we might want to buy these companies when valuation looks attractive.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

Note: In the last week of every month, I will show the updated watchlist for our American dividend growers, The List-USA. It will be shown after the Canadian watchlist below.

Performance of 'The List'

Last week, dividend growth stayed the same, with an average return of +6.9% YTD (income).

The price of 'The List' was down from the previous week, with an average YTD return of +10.8% (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week's best performers on 'The List' were Franco Nevada (FNV-N), up +6.75%.; Toromont Industries (TIH-T), up +3.78%; and TD Bank (TD-T) up +1.95%.

Thomson Reuters (TRI-Q) was the worst performer last week, down -6.06%.

Enghouse Systems Limited (ENGH-T) was the worst performer last week, down -8.40%.

From breaking news to quarterly earnings reports, we break down the week’s biggest headlines to help you make sense of the market. The full newsletter has even more insights and analysis, don’t miss out!

Keep reading with a 7-day free trial

Subscribe to Magic Pants Dividend Growth Investing-MP Market Review to keep reading this post and get 7 days of free access to the full post archives.