Timely Ten: Big Moves in This Month’s Rankings — One Stock Soars 18 Spots!

MP Market Review - May 16, 2025

Summary

Welcome to this week’s MP Market Review – your go-to source for insights and updates on the Canadian dividend growth companies we track on The List! While we’ve expanded our watchlists to include U.S. companies, The List-USA, our Canadian lineup remains the cornerstone of our coaching approach.

Don’t miss out on exclusive newsletters and premium content that will help you sharpen your investing strategy. Explore it all at magicpants.substack.com.

Your journey to dividend growth mastery starts here – let’s dive in!

Last week, dividend growth stayed the same with an average return of +6.9% YTD (income).

Last week, the price of The List was up from the previous week with an average return of +5.9% YTD (capital).

Last week, there were no dividend announcements from companies on The List.

Last week, there was one earnings report from a company on The List.

This week, one company on The List will report on their off-cycle earnings.

DGI Clipboard

"Current yield, using its own historic yield as a guide, is, in my view, a fine valuation measure."

— Tom Connolly

Timely Ten: Big Moves in This Month’s Rankings — One Stock Soars 18 Spots!

Intro

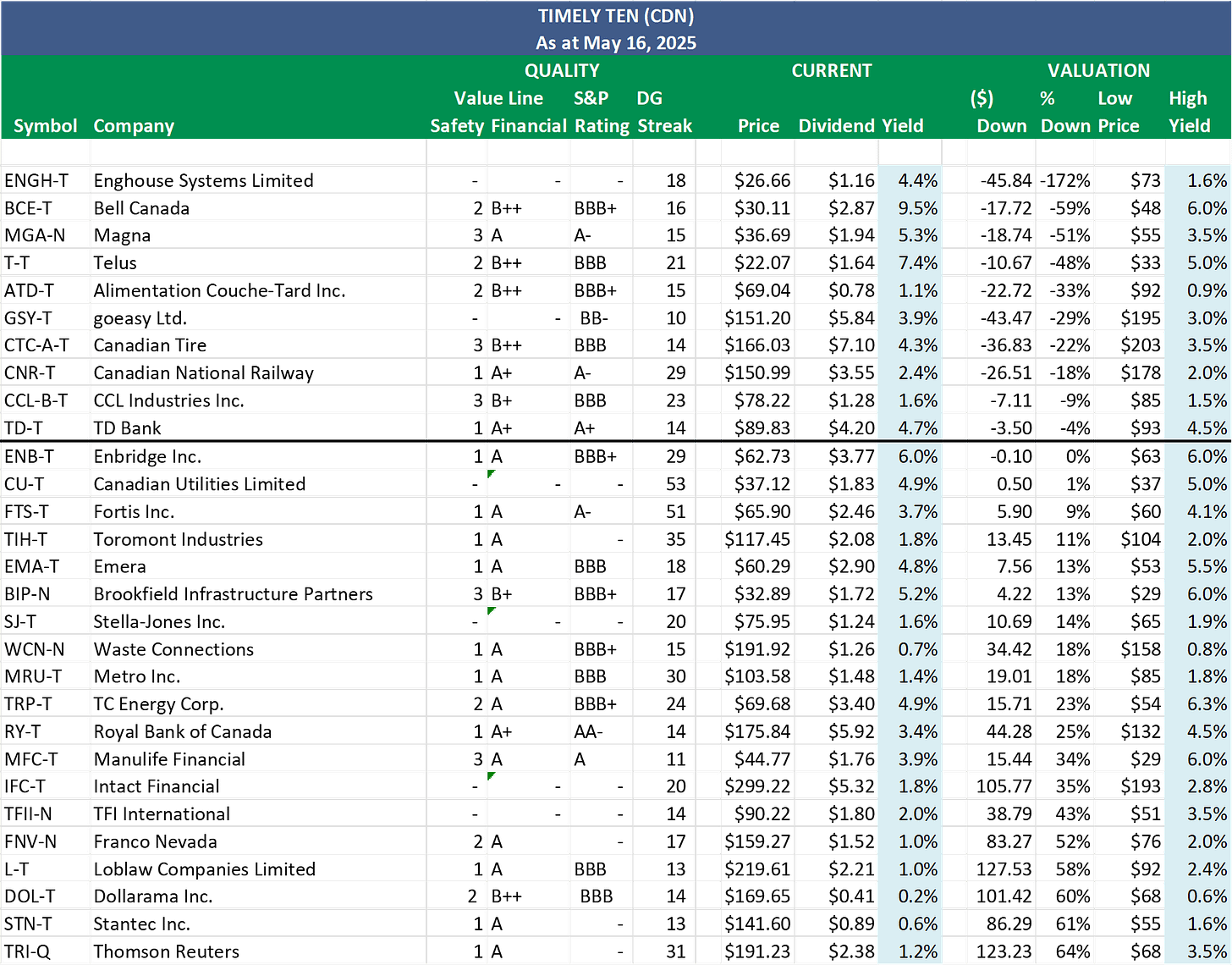

All ten names from last month’s Timely Ten (CDN) list remain undervalued, but there’s been notable movement within the ranks. CTC.A has slipped down the list, while ATD and GSY have moved up. Whether CTC.A can maintain its momentum is something to watch. ATD continues to be weighed down by uncertainty around its pursuit of Seven & i (owner of 7-Eleven), and GSY recently posted an earnings miss. Meanwhile, the market is beginning to recognize the intrinsic value in CCL.B and TD — both may graduate off the list soon.

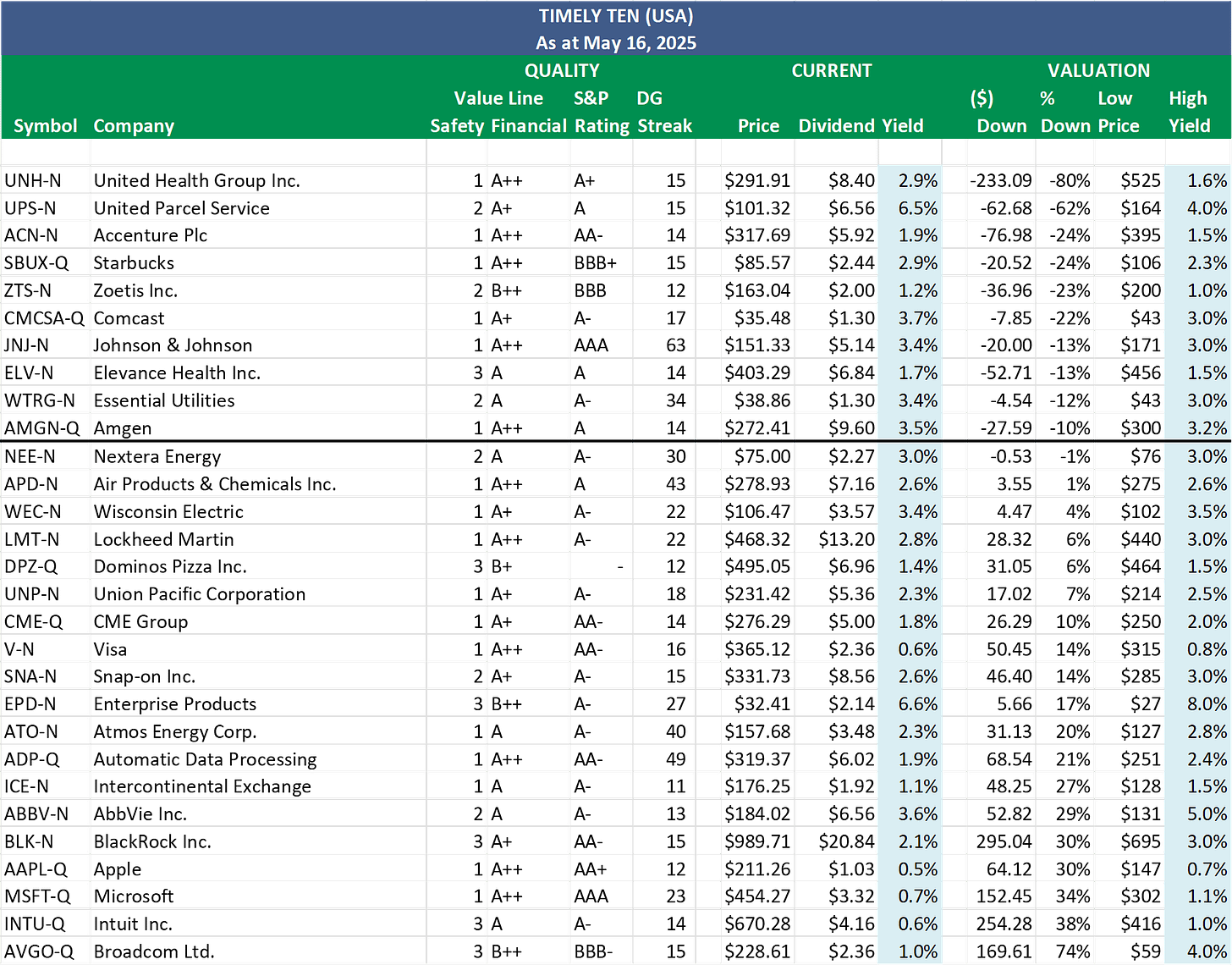

The headline change in our Timely Ten (USA) list is United Health, which jumped from 19th to 1st. The stock tanked after the U.S. Department of Justice launched a Medicare fraud investigation, alleging that UNH overstated patient diagnoses to bill Medicare more. Shortly after, the company withdrew guidance and unexpectedly announced a new CEO on May 13.

With several notable shifts this month, both lists present compelling starting points for further research. Each stock has already passed our rigorous screening process, so much of the heavy lifting has been done. If you'd like to follow along more closely or invest alongside us in our model portfolios, consider subscribing to our paid service.

Timely Ten

Below are the ten most undervalued dividend growth companies from our Canadian and U.S. watchlists, based on last Friday's closing prices.

Here's a recap on how we select our Timely Ten:

Step three in our process involves monitoring our quality dividend growers regularly, which can become quite challenging depending on the number of companies we track. Fortunately, we rely on 'The List' instead of the vast array of stocks in the index, which streamlines our task. Nevertheless, we continually seek methods to enhance our efficiency. Through dividend yield theory, we've discovered an approach that has proven remarkably effective in aiding us with our efforts over the years.

Dividend yield theory is a simple and intuitive approach to valuing dividend growth stocks. It suggests that the dividend yield of quality dividend growth stocks tends to revert to the mean over time, assuming that the underlying business model remains stable. In practical terms, if a stock pays a dividend yield above its ten-year average annual yield, its price will likely increase to return the yield to its historical average. Knowing that price and yield go in opposite directions, this theory helps us find stocks poised for a favourable price correction.

We have pre-screened our candidates using the criteria we initially laid out in building our watchlists. This helps us considerably narrow the universe of investable stocks.

Dividend growth streak: 10 years or more.

Market cap: Minimum one billion dollars.

Diversification: Limit of five companies per sector, preferably two per industry.

Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Next, we rank our Canadian and American watchlists based on how far each stock's price is below its fair value (Low Price), as determined by dividend yield theory. To find fair value, divide the current dividend (Dividend) by the stock's historical high yield (High Yield).

Since price and yield move in opposite directions, a lower price results in a higher yield, and vice versa. The ten companies above the thick black line have a current price (Price) below fair value (Low Price). Put simply, these stocks have a current dividend yield higher than their historically high yield. According to dividend yield theory, these companies are sensibly priced and have the highest probability of a price increase in the short term. These are our Timely Ten.

Wrap Up

When making investment decisions, always prioritize a company's 'quality' over a 'sensible price’. For more details on our quality indicators, download our Free Guide to Finding Quality Dividend Growth Stocks here.

If you're a new investor looking to build positions in the 'Timely Ten,' now is the perfect time to start your research and act.

Join as a paying subscriber to gain full access to this post and exclusive, subscriber-only content. Plus, get real-time DGI alerts from our model signaling service whenever we make trades in our portfolios. We do the work; you stay in control. Subscribe today and take your dividend growth investing to the next level!

DGI Scorecard

The List (2025)

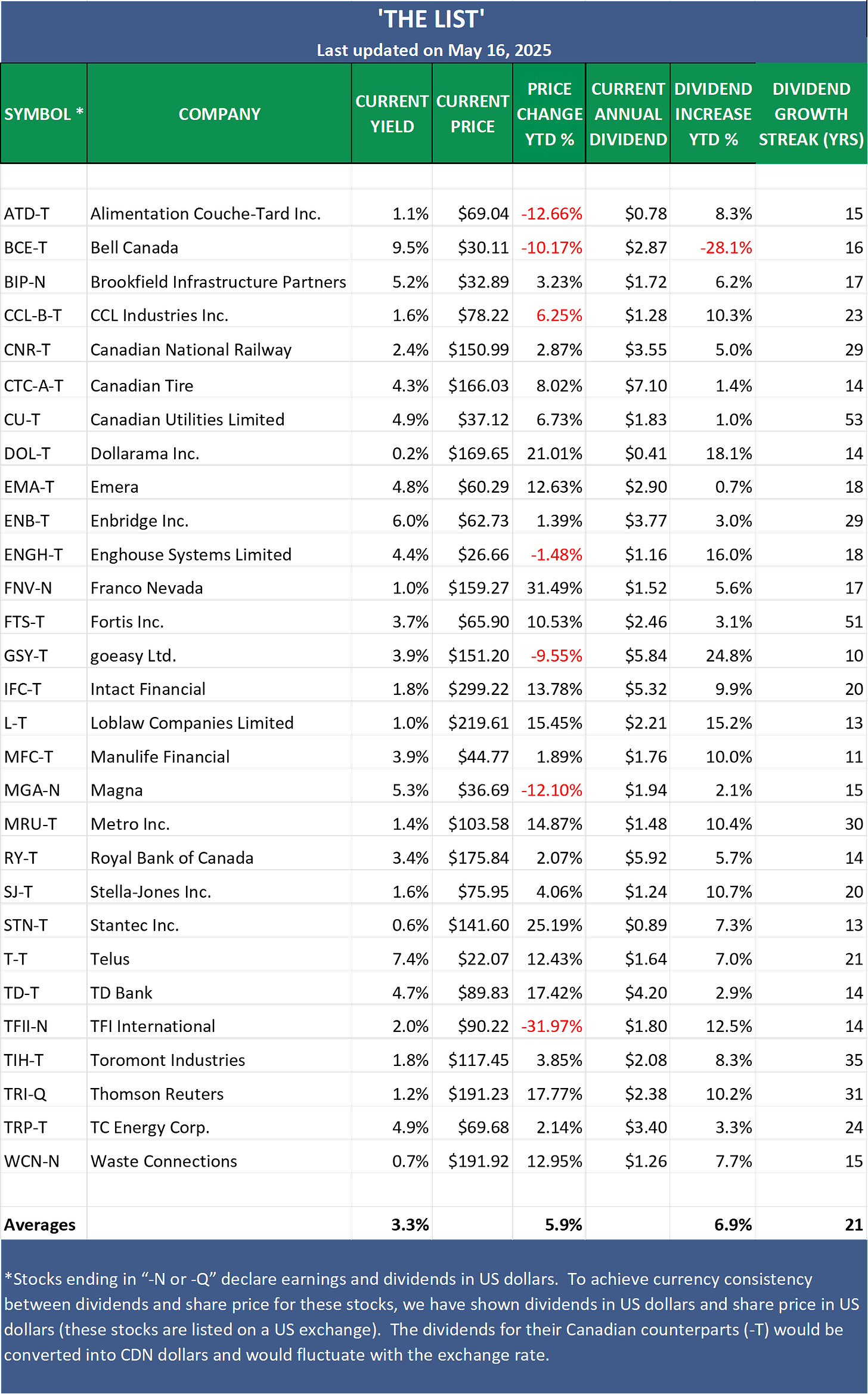

The Magic Pants 2025 list includes 29 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

Dividend growth streak: 10 years or more.

Market cap: Minimum one billion dollars.

Diversification: Limit of five companies per sector, preferably two per industry.

Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio but a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on ‘The List’. In other words, we might want to buy these companies when valuation looks attractive.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

Note: In the last week of every month, I will show the updated watchlist for our American dividend growers, The List-USA. It will be shown after the Canadian watchlist below.

Performance of 'The List'

Last week, dividend growth stayed the same, with an average return of +6.9% YTD (income).

The price of 'The List' was up from the previous week, with an average YTD return of +5.9% (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week's best performers on 'The List' were TFI International (TFII-N), up +9.25%.; Canadian National Railway (CNR-T), up +7.87; and Stantec Inc. (STN-T) up +7.81%.

Franco Nevada (FNV-N) was the worst performer last week, down -5.89%.

Earnings season is over, with Stantec reporting last week. Visit our news and updates sections for key highlights, including tactics for DIY investors and the recent downgrade on the US debt by a reputable rating agency.

Keep reading with a 7-day free trial

Subscribe to Magic Pants Dividend Growth Investing-MP Market Review to keep reading this post and get 7 days of free access to the full post archives.