Summary

Welcome to this week’s MP Market Review – your go-to source for insights and updates on the Canadian dividend growth companies we track on ‘The List’! While we’ve expanded our watchlists to include U.S. companies (The List-USA), our Canadian lineup remains the cornerstone of our coaching approach.

Don’t miss out on exclusive newsletters and premium content that will help you sharpen your investing strategy. Explore it all at magicpants.substack.com.

Your journey to dividend growth mastery starts here – let’s dive in!

Last week, dividend growth stayed the same, with an average return of +2.3% YTD (income).

Last week, the price of 'The List' was up from the previous week with an average return of +2.6% YTD (capital).

Last week, there were no dividend announcements made by companies on 'The List'.

Last week, there were no earnings reports from companies on 'The List'.

This week, three companies on 'The List' are due to report earnings.

DGI Clipboard

"The first $100,000 is a b*h, but you gotta do it. I don’t care what you have to do—if it means walking everywhere and not eating anything that wasn’t purchased with a coupon—even if it takes years to do it. You’ve got to get there. Once you get there, you can ease off a bit, because the next $100,000 is not as hard."

- Charlie Munger

How to Invest $100,000 and Get Your “Snowball” Rolling

Intro

In just a couple of weeks, we’ll be sharing another quarterly review of our model portfolio, highlighting the consistent power of dividend growth investing across all market conditions.

What makes this journey even more compelling is that we started our model portfolio back in 2022, a year when the market posted negative returns. Despite those challenging conditions, our strategy has continued to deliver steady progress—proving that dividend growth investing thrives even in uncertain times.

Stay tuned as we dive into the numbers and showcase the long-term potential of this disciplined approach!

The quote above perfectly reflects Charlie Munger's practical wisdom on the challenges of building wealth and the importance of reaching that crucial first financial milestone. His focus on the first $100,000 highlights the need for disciplined saving, consistent investing habits, and, most importantly, patience.

Why is this milestone so significant? Once your financial "snowball" hits a certain size, the magic of compounding begins to take over. At that point, wealth-building shifts from being a grind to a process where exponential growth does much of the heavy lifting. It’s the hardest part of the journey—but also the most rewarding.

On the blog, we walk you through our step-by-step process (The MP Wealth-Builder Model Portfolio (CDN) – Business Plan) for conservatively growing your initial “snowball” into a sustainable source of wealth. Our approach includes buy/sell alerts whenever we make trades in the model portfolio, so you can follow along with confidence. With consistent monthly contributions of $1,000, you’ll keep the snowball rolling and growing over time.

If you’ve got some runway before retirement, this business plan is designed to help most DIY investors achieve a comfortable and secure retirement. The key is simple: start now.

Our last two columns highlight the incredible power of compounding, showing how your dividend income and capital can grow exponentially over time. This tried-and-true strategy rewards patience and discipline. Ready to build your snowball?

Wrap Up

One of our subscribers has shared an inspiring way they’re using our blog to teach their adult children how to invest. Mom and Dad provide the initial capital, while the kids contribute $1,000 every month to meet their annual contributions. What a brilliant strategy to set your kids up for financial success without putting a strain on your retirement savings!

Next week, we’ll take this concept to the next level. We’ll share a business plan starting with $1,000,000 and a 10-year horizon until retirement. This approach will demonstrate how to achieve what most investors only dream of: Investing $1,000,000 and Living Off Dividends Forever. Don’t miss it!

For a more guided approach, when building your “snowball,” consider becoming a PAID subscriber to unlock access to DGI Alerts. These alerts notify you whenever we make a trade in our model portfolios, allowing you to invest alongside us with confidence. We do the work, and you stay in control!

DGI Scorecard

The List (2025)

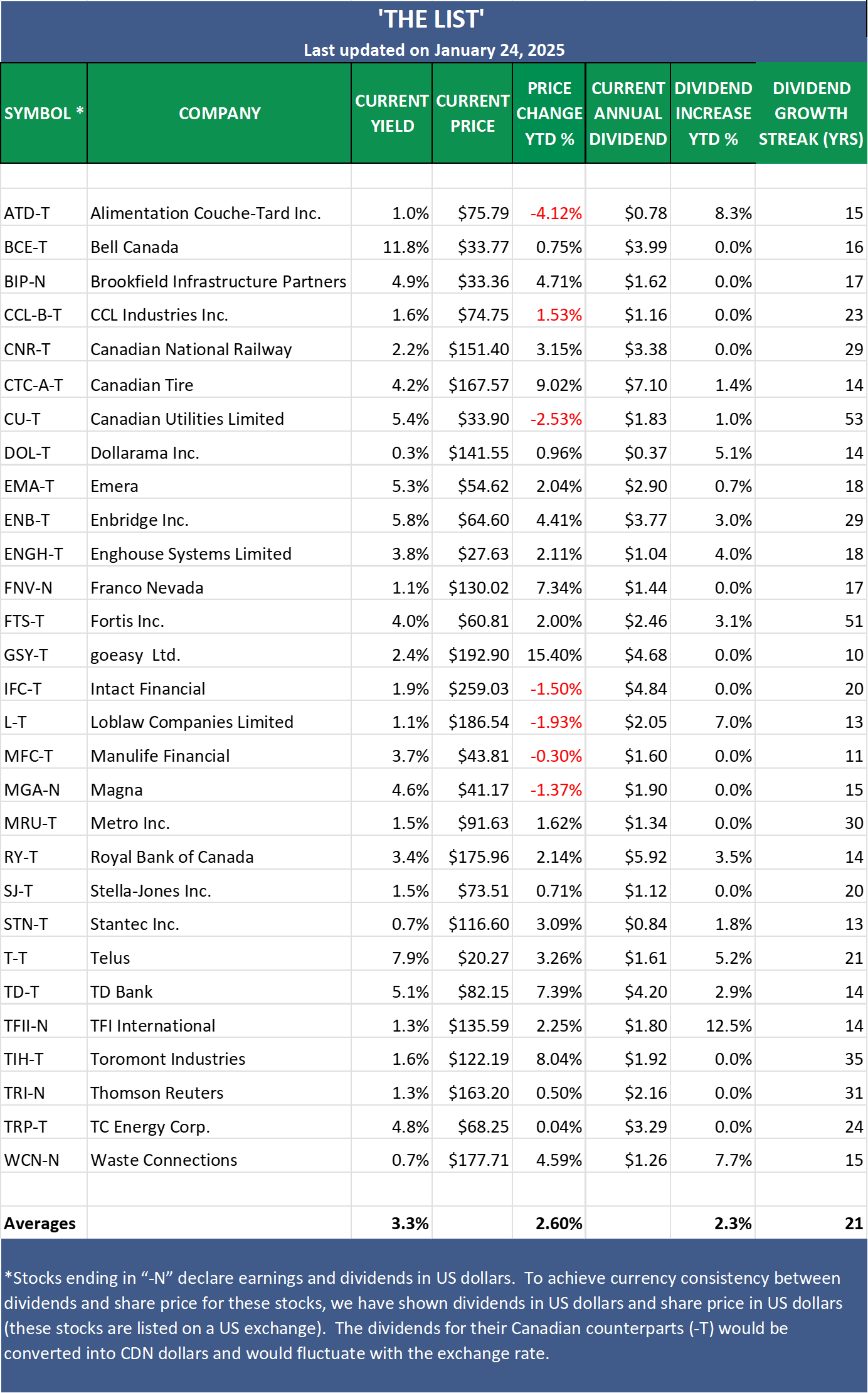

The Magic Pants 2025 list includes 29 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on ‘The List’:

Dividend growth streak: 10 years or more.

Market cap: Minimum one billion dollars.

Diversification: Limit of five companies per sector, preferably two per industry.

Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from ‘The List’ annually on January 1. Prices and dividends are updated weekly.

‘The List’ is not a portfolio but a coaching tool that helps us think about ideas and manage risk in our model portfolio. We own some but not all the companies on The List.

Our newsletter provides readers with comprehensive insight into the implementation and advantages of our dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform actively managed dividend funds, passively managed indexes, and dividend ETFs over longer-term horizons.

For those interested in more, please upgrade to a paid subscriber. You'll receive the enhanced weekly newsletter, access to premium content, full privileges on the new Substack website (magicpants.substack.com), and DGI alerts whenever we make stock transactions in our model portfolio.

Performance of 'The List'

Last week, dividend growth stayed the same, with an average return of +2.3% YTD (income).

Last week, the price of 'The List' was up from the previous week with an average return of +2.6% YTD (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week's best performers on 'The List' were goeasy Ltd. (GSY-T), up +10.87%; Brookfield Infrastructure Partners (BIP-N), up +6.86%; and Dollarama Inc. (DOL-T), up +6.16%.

Canadian Utilities Limited (CU-T) was the worst performer last week, down -1.48%.

Find out which companies are reporting earnings this week and why pipeline stocks have been making headlines lately. Plus, hear directly from Bell Canada’s CEO on his plan to regain investor confidence.

The full newsletter has all the insights and analysis—don’t miss out!

Keep reading with a 7-day free trial

Subscribe to Magic Pants Dividend Growth Investing-MP Market Review to keep reading this post and get 7 days of free access to the full post archives.