Summary

Welcome to this week’s MP Market Review – your go-to source for insights and updates on the Canadian dividend growth companies we track on The List! While we’ve expanded our watchlists to include U.S. companies, The List-USA, our Canadian lineup remains the cornerstone of our coaching approach.

Don’t miss out on exclusive newsletters and premium content that will help you sharpen your investing strategy. Explore it all at magicpants.substack.com.

Your journey to dividend growth mastery starts here – let’s dive in!

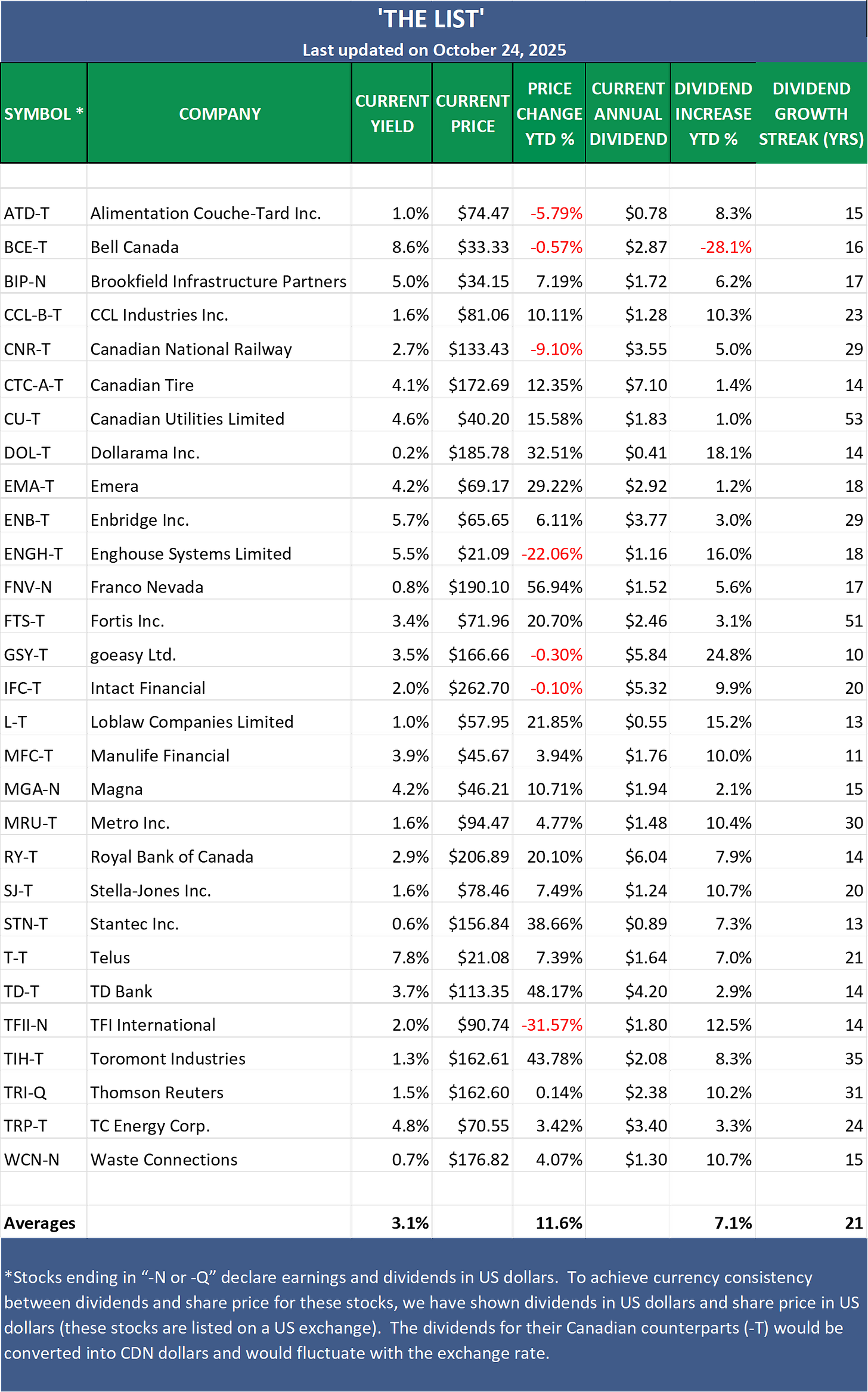

Last week, dividend growth of The List was up with an average return of +7.1% YTD (income).

Last week, the price of The List was up from the previous week with an average return of +11.6% YTD (capital).

Last week, there was only one dividend announcement from a company on The List.

Last week, there was one earnings report from companies on The List.

This week, four companies from The List will report on earnings.

DGI Clipboard

“Once valuations become unusually rich, disappointingly long-term returns are baked in the cake.”

— John Hussman

How to Get the Most Out of Our Weekly Newsletter

Intro

Your Guide to the Magic Pants Dividend Growth Newsletter

Last week, we introduced “The Retirement Plan You Can Write on a Napkin.” We also pointed out that although our dividend growth investing (DGI) strategy is simple to understand, it is not easy. That is why this newsletter exists: to keep you focused through the noise and emotions that come with disciplined long-term investing.

Each issue is designed to help you stay grounded week to week and calm over the long haul. Here’s what to look for:

1. The Opening Snapshot

We begin with a clear headline and a quick snapshot of key DGI metrics:

Year-to-date dividend and price growth from The List

Dividend announcements

Earnings updates

Think of it as your fast weekly briefing.

2. The DGI Clipboard: Where the Coaching Happens

This is the heart of the newsletter. Each week, I dig into an investing topic, connect it to our DGI strategy, and share supporting quotes or charts.

It is called the Clipboard because this is where the real coaching happens, just like drawing up plays behind the bench in a hockey game.

3. The DGI Scorecard: Tracking Our Watchlist

Here we track the performance of The List, highlighting the week’s top and bottom performers. On the final week of each month, we also share a similar scorecard for The List-USA, giving you a clear view of trends on both sides of the border.

Key metrics to watch:

Starting yield

Dividend growth (YTD)

Price change (YTD)

If price runs ahead of yield plus dividend growth, valuations may be getting stretched. If it lags, opportunities may be emerging.

Reminder: The List is a teaching tool, not a portfolio.

4. DGI News: Cutting Through the Noise

Each week, I select a few relevant headlines, share the links, and add a quick take. This saves you time and keeps you informed on what the financial media is saying and what the markets are doing.

5. DGI Updates: Company Earnings and Dividend Moves

We finish with updates from companies on The List:

Dividend announcements

Quarterly earnings recaps

Links to full earnings reports

For paid subscribers, this section provides additional research for those wanting to understand the companies we follow a bit better.

Takeaway

This is more than a newsletter. It is your coaching tool for building a growing and reliable income stream while helping you stay disciplined over time.

Become a paid partner, and I’ll show you exactly how I do it. With real money. In real stocks. In addition, gain full access to this post and exclusive, subscriber-only content. We do the work; you stay in control. Subscribe today and take your dividend growth investing to the next level!

DGI Scorecard

The List (2025)

The Magic Pants 2025 list includes 29 Canadian dividend growth stocks. Here are the criteria to be considered a candidate on The List:

Dividend growth streak: 10 years or more.

Market cap: Minimum one billion dollars.

Diversification: Limit of five companies per sector, preferably two per industry.

Cyclicality: Exclude REITs and pure-play energy companies due to high cyclicality.

Based on these criteria, companies are added or removed from The List annually on January 1. Prices and dividends are updated weekly.

The List is not a portfolio but a coaching tool that helps us think about ideas and risk manage our model portfolio. We own some but not all the companies on The List. In other words, we might want to buy these companies when valuation looks attractive.

Our newsletter provides readers with a comprehensive insight into the implementation and advantages of our dividend growth investing strategy. This evidence-based, unbiased approach empowers DIY investors to outperform both actively managed dividend funds and passively managed indexes and dividend ETFs over longer-term horizons.

Note: In the last week of every month, I will show the updated watchlist for our American dividend growers, The List-USA. It will be shown after the Canadian watchlist below.

Performance of 'The List'

Last week, dividend growth was up, with an average return of +7.1% YTD (income).

The price of ‘The List’ was up from the previous week, with an average YTD return of +11.6% (capital).

Even though prices may fluctuate, the dependable growth in our income does not. Stay the course. You will be happy you did.

Last week’s best performers on ‘The List’ were CCL Industries Inc. (CCL-B-T), up +4.85%.; goeasy Ltd. (GSY-T), up +4.55%; and Toromont Industries (TIH-T) up +3.59%.

Franco Nevada (FNV-N) was the worst performer last week, down -6.67%.

From breaking news to quarterly earnings reports, we break down the week’s biggest headlines to help you make sense of the market. The full newsletter has even more insights and analysis, don’t miss out!

Keep reading with a 7-day free trial

Subscribe to Magic Pants Dividend Growth Investing-MP Market Review to keep reading this post and get 7 days of free access to the full post archives.